Banking use case: Let the customers wish for more banking services

In 2018, Qualtrics XM Institute (formerly Temkin), an American consultancy firm, which also researches user experience and behavioral patterns of bank clients, released the information that almost 70% of clients are considering changing their bank due to poor support rather than the bank’s unsuitable offer. 56% of those who decided to take their business elsewhere said that the bank did not make any move to keep them as its clients. The clients see the support and effort to keep them extremely important.

Below, you can read how to spontaneously maintain interaction with bank clients, provide them with information on new developments, and suggest products and services they are interested in.

But first, let us consider: What is the most appropriate approach?

Today, people need more than a few bank services but wish to simplify communication at the same time. That is why modern banking increasingly uses digital channels. As far back as 2015, Accenture forecast that within 10 years the ‘old school’ banking would completely switch to innovative digital banking systems and utility providers. It also noted that European banks do not follow rapid changes in behavioral patterns of consumers in the time of global digitalization, in particular not in the sense of addressing their clients. Keeping up with change is reflected in the above-mentioned reasons for changing banks.

However, the fact mentioned by Temkin in 2018 that consumers remain loyal to their bank or credit line for 14 to 15 years on average is encouraging. This period is long enough to attract the client, build their trust and consolidate their loyalty to the extent that the client not only stays but also recommends the bank to others. How?

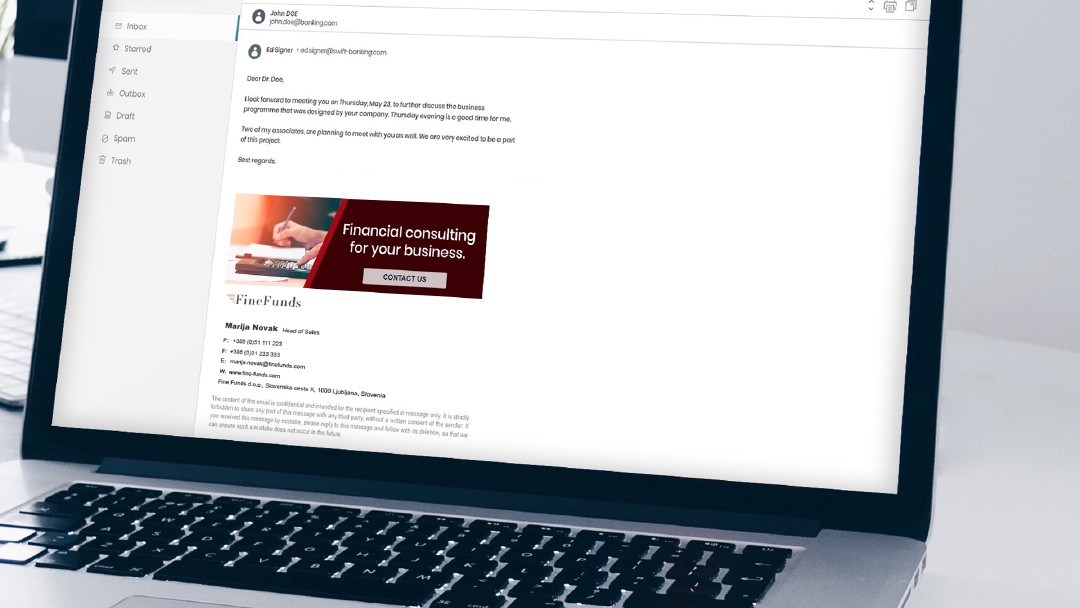

In a digital way. By integrating upselling and cross-selling activities in digital channels and consistent, strategically planned email communication. An additional advertising banner in the email signature of each sent email which is automatically changed within a set timeframe provides both.

Example 1: Personal consultants are given 6 million additional sales opportunities

Let us look at the example of a bank with 3 million users per year. The banking consultant interacts with each user via email at least twice a year. Either due to changes in the existing cooperation, new offer, or support in using banking tools. This means 6 million new sales opportunities for the bank per year through the advertising banners in the email signature of the consultant, which is different each time and attractive.

Example 2: Bank e-statements – personalized advertising opportunities

There are fewer and fewer personal visits to bank branches. At the same time, clients are increasingly avoiding paper forms and documents. Printed reports of monthly credit card services are rare. They were replaced by bank e-statements sent directly to an inbox on a monthly basis. At 1 million active users of card services this means 12 million additional marketing and sales opportunities per year which are provided by advertising banners added to the email signature of the main message of bank e-statement.

Example 3: Every new transaction is an opportunity for spontaneous upselling and cross-selling

With each new interest shown by the client, a new series of email messages begins between the potential user of a bank product and the banking consultant. From making inquiries and forming a suitable offer to coordination and exchange of final documents. A personal visit to the bank is virtually no longer necessary, so this kind of communication may last a few days or even weeks. Automatic replacement of advertising banners in the email signature of the banking consultant provides all information on the current offer of the bank, its new products, and relevant topics of interest.

In this way, a banking consultant specializing in the field of loans may also sell other banking products easily. Throughout the process of signing a large-scale credit facility, the banner on credit insurance has attracted the client to the extent that they also decided to sign up for the respective insurance. The transaction has been successful, and the initial expectation of both parties fulfilled and even positively exceeded.

The commercial use of the AdSigner online service is simple and clear; Each employee becomes a seller, and each email sent represents a strong move for maintaining the existing clients and acquiring new ones. However, all those who are already engaged in sales can improve their results with spontaneous upselling and cross-selling of banking products and services.