Insurance business use case: Sell more insurance policies

Are you an insurance agent or broker? Employees of an insurance company or an insurance broking company communicate a lot every day and professional answers are their competitive advantage. They must also be very flexible regarding their time to conclude as many insurance policies as possible. And maintain them over the years. Electronic mail makes their operations significantly easier, since nowadays most of the documents can be exchanged with the clients per email. Per email, each new or existing client usually receives:

- An introductory presentation of insurance products according to the inquiry,

- an informative calculation with an offer,

- an insurance policy with the insurance terms and conditions,

- a notification of impending expiration of a policy.

On an annual level, such electronic mail is joined by others in case of:

- Individual questions,

- possible needs for policy changes,

- loss events,

- tourist insurance,

- cancellation insurance.

Nine electronic mails of this kind mean 900 sales opportunities every year, if the insurance agent deals with approximately 100 clients. And every single one of them enables growth of sales through cross-selling or upselling of insurance products.

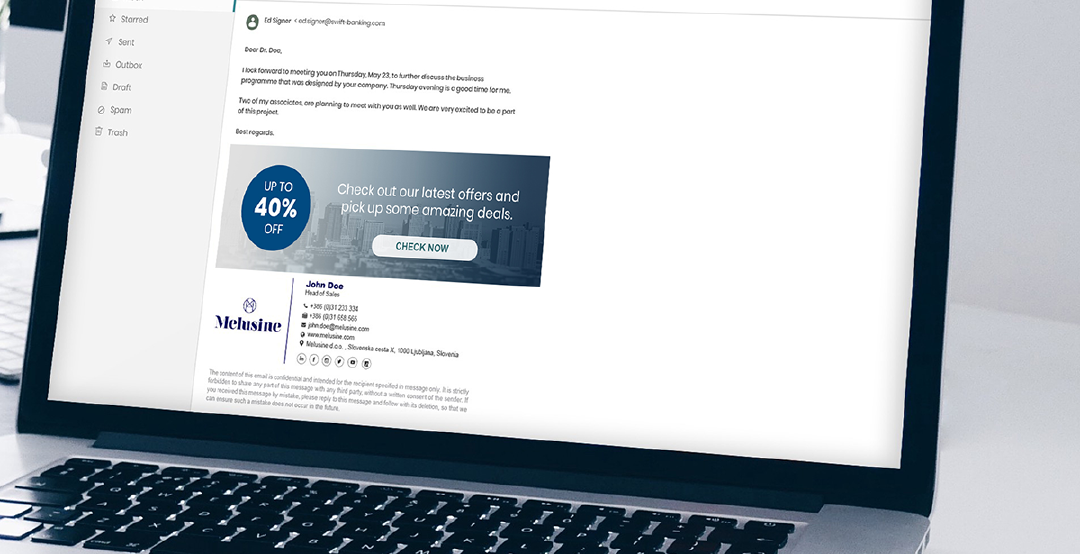

Because the messages are of a personal nature, the client is always interested in reading them. And here, the sales revolution happens. In the email signature, the client notices the attractive advertising banner. And the new purchase route to the client is established. Automatically. With a professional email signature and an attached banner the insurance agent:

- attracts additional attention by the client,

- as an organised, modern counterpart establishes an even stronger business relationship,

- informs the client about news in the field of insurance,

- educates the client with answers to frequently asked questions, and last but not least, what is most important for the business growth:

- informs the client about additional, new and compatible products they would likely be interested in.

Let us look at specific examples of how an advertising banner in the email signature of an insurance agent can impact the client’s purchase process and thus importantly upgrade their business.

The client increases the scope of the insurance premium – Upsell

When it comes to life, accident and investment insurance policies, people often think they do not need them. Only when they see an actual calculation are they persuaded that a minimum premium can mean a high payout amount. The insurance company has developed a two-month advertising campaign. In the email signatures of its employees, it is showing the actual calculations of the paid out insurance sums in different situations regarding accident, life and investment insurance. During the campaign and one month after the campaign, the number of newly concluded accident and life insurances grew significantly. In the context of the investment insurances, the monthly premiums the policyholders were prepared to pay rose. The move from awareness to sales was accelerated by the advertising banners which were automatically displayed and changed by AdSigner.

The client chooses a new insurance agent – Sell

A family is going on vacation. They have requested a quote for tourist insurance for informational purposes. The insurance agent answers them by email. Since it is the vacation period, the insurance agent’s email signature is displaying the advertising banner: “Have you taken care of your car insurance before going on holiday?” The family would have forgotten to renew their car insurance and it would have expired while they were on holiday. Happy about the reminder in the advertising banner which has saved them trouble during their vacation, they have concluded two insurance policies with this insurance company; tourist insurance and car insurance which was set up with a different company before. Both thanks to the AdSigner advertising banner.

The client concludes even more insurance policies – Cross-sell

We often conclude different insurance policies with different insurance agents or brokers. The client has been in contact with the broker all week regarding a new car insurance policy. They have exchanged an email everyday. In the broker’s email signature, the client has noticed banners containing a different, informative and practical fact about the different types of insurance and loss events every day. The client was happy to find out some useful facts and decided to inquire further about the agent’s other insurance products they needed. Before the end of the week, the insurance broker was able to sign two policies with the client thanks to their professional, strategic appearance via banners. One policy was renewed and the second newly concluded for the period of 20 years. Thanks to the tool enabled by AdSigner.

Let AdSigner become your sales assistant when setting up insurance. Familiarise yourself with it with a 14-day free trial now.